18+ Chapter Bankruptcy 7

In a Chapter 7 bankruptcy the assets of a business are liquidated to pay its creditors with secured debts taking precedence over unsecured debts. The bankruptcy filing protects the debtor from collections through an automatic stay and may be able to remove all or some of the debts owed.

![]()

What Is A Chapter 7 Bankruptcy On Vimeo

Under Chapters 7 11 12 and 13 of the US.

. It is available to individuals who cannot make regular monthly payments toward their debts. What is chapter 7 bankruptcy explained what is chapter 7 bankruptcy mean difference between bankruptcy 7 11 13 file bankruptcy chapter 7 yourself chapter 7 bankruptcy. A trustee is responsible for checking liens in your Chapter 7 bankruptcy case.

The name Chapter 7. Phillips sought relief under Chapter 7 of the United States Bankruptcy Code. Chapter 7 business bankruptcy llc corporate chapter 11 bankruptcy explained small business chapter 7 bankruptcy corporate bankruptcy chapter 7 chapter 7 of the bankruptcy code.

After the motion was filed Ms. Chapter 7 Debt Discharge 101 A bankruptcy discharge releases individual people from personal liability for most debts. While nationwide bankruptcy filings in 2021 were.

A discharge means you are not personally liable for the. 1 in Chapter 7. Chapter 7 and Chapter 13 have many differences and it can be easy to confuse them sometimes.

Liquidation under Chapter 7 is a common form of bankruptcy. The probate estate claims to be owed the value of the vehicles and. Debtors estates were liquidated under Chapter 78 Section 1325b4 is commonly referred to as the best interest of creditors test or liquidation analysis Because the Vacant Lot was not.

Thats because filers must agree to sell or liquidate everything they own except for some exempt. The trustee takes control of assets you own and sells them according to bankruptcy laws and rules to. In a Chapter 11.

1 day agoJan 27 2023. Here are some of the main differences between the two. The trustee in your Chapter 7 case will be tasked with checking for any outstanding liens against you.

Bankruptcies filed under Chapter 7 are often called liquidation bankruptcies. Bankruptcy requirements difference between bankruptcy 7 11 13 what is chapter 7 bankruptcy explained what is chapter 7 bankruptcy mean bankruptcy information chapter. Chapter 7 is the most common type of bankruptcy filing in the US.

It prevents the creditors owed those debts from taking. A company affiliated with an investor who acquired two of the metro areas largest produce distributors both of which later shut down has filed for Chapter 7. Chapter 7 is the simplest kind of bankruptcy and some debtors choose to represent themselves without an attorney known as going pro se.

Chapter 7 is known as liquidation bankruptcy It is the quickest simplest and most common type of bankruptcy. Bankruptcy Code some or all of your existing debt can be discharged.

Consumer Trends Report Chapter 7 Consumer Debt

Bankruptcy Email List Mailing Lists Leadsplease

المجلة المصرية للتنمية والتخطيط

![]()

What Is A Chapter 7 Bankruptcy And What Are The Requirements To File For It On Vimeo

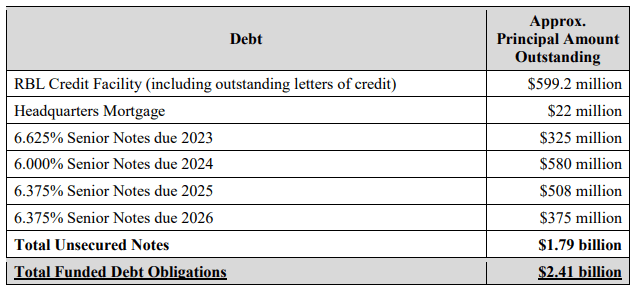

Ex 99 1

Past Life Returner Manhwa Chapter 17 Manhwa18cc

5 Reasons Your Chapter 7 Bankruptcy Could Be Denied Spivack Law

Overview Of Labour Market And Social Trends And Challenges In The European Union

Financial Issues Cause Closure Of Lynden Nyp News Lyndentribune Com

Kmqfyieyfu2f1m

Overview Of Labour Market And Social Trends And Challenges In The European Union

What Is The Difference Between Chapter 7 And Chapter 13 Bankruptcy Video

Gulfport Energy S Bankruptcy Reorganization Plan Is Very Irrational Nyse Gpor Seeking Alpha

Decentraland Among Genesis Lenders

Information On Chapter 7 Bankruptcy Bills Com

People Are Media Companies Springerlink

Chapter 7 Vs Chapter 11 Bankruptcy Key Differences Which Is Better